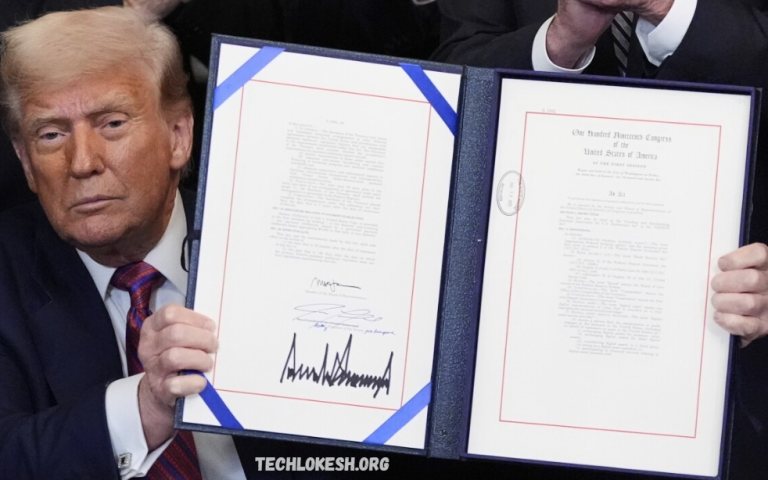

Former President Donald Trump has officially signed the GENIUS Act into law, marking a significant step in regulating stablecoins. This new legislation aims to establish a clear legal framework for these digital assets, which are designed to maintain a stable value by being pegged to traditional currencies, such as the US dollar. By legitimizing stablecoins, the government acknowledges their growing importance in the financial ecosystem and works to ensure they operate safely and transparently.

The GENIUS Act introduces specific guidelines for stablecoin issuers, including requirements for transparency, reserves, and consumer protections. This move is expected to foster greater trust among investors and users, while also reducing the risks associated with unregulated digital currencies. It also signals a shift in regulatory attitudes, showing a willingness to embrace innovation while maintaining oversight.

Overall, the signing of the GENIUS Act could lead to broader adoption of stablecoins in everyday transactions and the financial industry. By bringing these digital currencies under formal regulation, the law helps create a more stable and secure environment that fosters innovation, benefiting both consumers and businesses alike.

Trump Signs GENIUS Act: A New Era for Stablecoins

Donald Trump has officially signed the GENIUS Act into law, ushering in a new era for stablecoins in the United States. This landmark legislation establishes a clear regulatory framework for stablecoins, digital currencies designed to maintain a steady value by being pegged to traditional assets, such as the U.S. dollar. By placing stablecoins on a legitimate legal footing, the act acknowledges their growing role in modern finance and seeks to enhance trust and transparency in the digital currency market.

The GENIUS Act introduces important safeguards, including transparency requirements for stablecoin issuers and rules ensuring proper reserves are maintained to back the coins. Designed to protect consumers and mitigate risks associated with unregulated digital assets, while also fostering innovation within the financial technology sector. The law represents a significant shift towards balancing regulation with the dynamic growth of cryptocurrency markets.

Overall, the signing of the GENIUS Act signals broader acceptance of stablecoins as a mainstream financial tool. With clearer rules in place, this legislation is expected to foster greater adoption by businesses and consumers alike, supporting a more secure and stable environment for digital currency innovation to flourish.

GENIUS Act Becomes Law: What It Means for Stablecoins

The recent signing of the GENIUS Act into law marks a major milestone for stablecoins in the United States. Stablecoins, digital currencies pegged to stable assets like the U.S. dollar, have rapidly gained popularity for their ability to combine the benefits of cryptocurrencies with price stability. With this new legislation, stablecoins now have a clear legal framework, helping to legitimize their role in the evolving financial landscape.

The GENIUS Act outlines key guidelines for stablecoin issuers, including transparency standards and requirements to maintain sufficient reserves. Reduce the risks often associated with unregulated digital currencies. By providing regulatory clarity, the law encourages innovation while ensuring that stablecoins operate in a safe and trustworthy manner.

Ultimately, the passage of the GENIUS Act paves the way for wider acceptance and use of stablecoins in everyday transactions and the broader financial system. This law not only supports consumer confidence but also positions stablecoins as a vital part of the future of digital finance, blending innovation with regulatory oversight.

Stablecoins Get Legal Backing with Trump’s GENIUS Act

In a major move for digital currency regulation, former President Donald Trump has signed the GENIUS Act into law, giving stablecoins official legal backing. Until now, these digital currencies have operated in a regulatory gray area, creating uncertainty for users and investors. The GENIUS Act changes that by providing a clear legal framework for their operation.

The legislation introduces strict requirements for stablecoin issuers, including the need to hold sufficient reserves to fully back the coins they issue. It also sets transparency and reporting standards aimed at protecting consumers and maintaining financial stability. By doing so, the law reduces the risks associated with fraud and sudden losses, making stablecoins safer for everyday use.

This legal recognition opens the door to the wider adoption of stablecoins across various sectors, including online payments and traditional financial services. With the GENIUS Act in place, stablecoins are poised to become a trusted and regulated part of the financial landscape, encouraging innovation while safeguarding users.

Read Also: Solar Boom Adds Stress to National Electricity Grid

How the GENIUS Act Regulates and Supports Stablecoins

The GENIUS Act, recently signed into law by former President Donald Trump, brings much-needed clarity to the regulation of stablecoins. Currencies are designed to maintain a stable value by being tied to traditional assets, such as the U.S. dollar. Before this law, stablecoins operated in a somewhat uncertain regulatory space, raising concerns about consumer protection and financial stability. The GENIUS Act changes that by establishing clear rules for these digital assets.

Under the GENIUS Act, stablecoin issuers must meet strict requirements around transparency, reserves, and reporting. This means they need to maintain sufficient assets to back every stablecoin in circulation and regularly disclose their financial status to regulators. These measures protect consumers by reducing the risk of sudden losses or fraud and help build trust in the market.

By providing a legal framework, the GENIUS Act not only regulates but also supports the growth of stablecoins. The law encourages innovation in the financial technology sector while ensuring that stablecoins can safely be used in everyday transactions. Overall, this legislation is a significant step.

Trump’s Move to Legitimize Stablecoins: Key Highlights of the GENIUS Act

Former President Donald Trump’s signing of the GENIUS Act marks a pivotal moment for stablecoins, bringing these digital assets into the regulatory spotlight. Cryptocurrencies are designed to maintain a stable value by being tied to traditional currencies, such as the U.S. dollar. Until now, their legal status had been unclear, which had limited their widespread adoption. The GENIUS Act changes that by setting clear legal standards and legitimizing stablecoins as a safe and regulated financial tool.

One of the key features of the GENIUS Act is its emphasis on transparency and accountability. The law requires stablecoin issuers to maintain adequate reserves that fully back the coins they circulate. It also introduces regular reporting obligations, helping to protect consumers and reduce risks such as fraud or sudden value drops. These provisions are designed to foster trust and stability in the digital currency market.

By providing a solid legal framework, the GENIUS Act encourages innovation while ensuring safety and oversight. This move is expected to boost the use of stablecoins in everyday financial transactions and integration into the mainstream financial system. Trump’s signing of this law signals a new chapter for digital currencies in the U.S.

Frequently Asked Questions

Will the GENIUS Act encourage innovation?

Yes, the Act supports fintech innovation by creating a safe, regulated environment for developing and using stablecoins.

How will the law affect everyday use of stablecoins?

It makes stablecoins more reliable and trustworthy, encouraging their use in payments, investments, and other financial transactions.

Does the GENIUS Act regulate all cryptocurrencies?

No, it specifically focuses on stablecoins, not all types of cryptocurrencies, such as Bitcoin or Ethereum.

When did the GENIUS Act become law?

The Act was signed into law recently by former President Trump, marking a new chapter in digital currency regulation.

What’s the future outlook for stablecoins under this law?

With clear rules in place, stablecoins are expected to see wider adoption and greater integration into mainstream finance.

Conclusion

The signing of the GENIUS Act by former President Donald Trump marks a significant step forward in regulating and legitimizing stablecoins. By establishing clear rules around transparency, reserves, and consumer protection, the law creates a safer environment for digital currencies to thrive. This legislation not only protects users but also encourages innovation and broader adoption of stablecoins in everyday financial activities. As stablecoins gain legitimacy under this new legal framework, they are poised to play an increasingly important role in the future of finance, bridging the traditional world of money and the digital world with greater trust and stability.